1

1

www.angelbroking.com

Market Outlook

November 14, 2019

www.angelbroking.com

Market Cues

Indian markets are likely to open negative tracking global indices and SGX Nifty.

The US stocks showed a lack of direction during trading on Wednesday. Despite the

choppy trading, the Dow and the S&P 500 ended the session at new record closing

highs. While the Dow rose by 0.3 percent to at 27,783, the Nasdaq dipped by 0.1

percent to 8,482.

The UK stocks fell on Wednesday after U.S. President Donald Trump threatened to

levy even more tariffs against Chinese goods if a trade deal is not reached. Another

day of Hong Kong turmoil also rattled investors. The FTSE 100 fell by 0.5 percent to

7,325.

On domestic front, Indian shares fell on yesterday, mirroring weak cues from Asia

and Europe as anti-government protests in Hong Kong entered a third consecutive

day of violent unrest and new worries around a U.S.-China trade agreement

emerged. The benchmark BSE Sensex slumped 0.6 per cent to 40,116.

News Analysis

Industrial output shrinks by 4.3%, steepest decline in eight years

Detailed analysis on Pg2

Investor’s Ready Reckoner

Key Domestic & Global Indicators

Stock Watch: Latest investment recommendations on 150+ stocks

Refer Pg5 onwards

Top Picks

Company

Sector

Rating

CMP

(`)

Target

(`)

Upside

(%)

Blue Star

Capital Goods

Buy

791

990

25.1

ICICI Bank

Financials

Accumulate

497

532

7.1

GMM Pfaudlers

Others

Buy

1,452

1,740

19.8

Bata India

Others

Accumulate

1,704

1,865

9.4

HDFC Bank

Financials

Accumulate

1,264

1,390

10.0

More Top Picks on Pg4

Domestic Indices

Chg (%)

(Pts)

(Close)

BSE Sensex

-0.6

-229

40,116

Nifty

-0.6

-73

11,840

Mid Cap

-0.8

-114

14,660

Small Cap

-1.1

-153

13,345

Bankex

-1.9

-674

34,586

Global Indices

Chg (%)

(Pts)

(Close)

Dow Jones

0.3

92

27,783

Nasdaq

(0.1)

(4)

8,482

FTSE

(0.5)

(40)

7,325

Nikkei

0.1

26

23,330

Hang Seng

0.6

159

27,847

Shanghai Com

0.01

1

2,978

Advances / Declines

BSE

NSE

Advances

941

678

Declines

1,640

1,176

Unchanged

157

100

Volumes (` Cr)

BSE

2,676

NSE

41,639

Net Inflows (` Cr)

Net

Mtd

Ytd

FII

81

1,888

(2,35,294)

*MFs

(203)

(762)

48,947

Top Gainers

Price (

`

)

Chg (%)

EIDPARRY

195

19.6

GODFRYPHLP

1250

7.3

RAYMOND

791

5.7

INDHOTEL

156

6.4

GET&D

183

10.1

Top Losers

Price (

`

)

Chg (%)

SUNTV

470

-11.1

DISHTV

13

-9.7

BOMDYEING

83

-9.1

IBULHSGFIN

218

-8.4

VENKYS

1699

-8.1

As on Nov 13, 2019

2

www.angelbroking.com

Market Outlook

November 14, 2019

www.angelbroking.com

News Analysis

Retail inflation surges to 4.62%, breaches RBI comfort level after

15 months

The rate of retail inflation, as measured by the Consumer Price Index (CPI)

breached the Reserve Bank of India’s (RBI’s) medium-term target of 4 per cent in

October, for the first time in 15 months, on the back of higher food prices.

The CPI-inflation rate had stood at 3.99 per cent in September and 3.38 per cent

in October 2018.

The food inflation rate rose to 7.9 per cent, the highest in 39 months, with

vegetables (up 26 per cent) and pulses (up 11.7 per cent) contributing the most to

this. Food inflation in urban areas, at 10.7 per cent, is the highest in six years.

But the core inflation rate, which excludes the volatile components food and fuel,

dropped to its lowest in the past eight years, at 3.3 per cent, in October.

Core inflation represents the demand and pricing power in the economy, and a

sharp drop in October portends feeble prospects of recovery in the current quarter

also.

Economic and Political News

Govt widens scope for anti-dumping duty on jute yarn, sacks from Bangladesh

Supreme Court strikes down amended Finance Act rules for tribunals

UP govt to set up biofuel plants to address issue of stubble burning

Corporate News

Vedanta emerges as the highest bidder for Jamkhani coal block in Odisha

JSW's Bhushan Power acquisition in deep freeze as ED refuses to relent

Tata Motors to raise up to $300 mn by issuing bonds in November

Yes Bank faces fresh audit into complaints by whistleblower

3

www.angelbroking.com

Market Outlook

November 14, 2019

www.angelbroking.com

Quarterly Bloomberg Brokers Consensus Estimate

Apollo Hospital Ltd – November 14, 2019

Particulars (` cr)

2QFY20E

2QFY19

y-o-y (%)

1QFY20

q-o-q (%)

Sales

2,405

2,090

15.1

2,229

7.9

EBIDTA

352

258

36.6

326

8.1

%

14.7

12.3

14.6

PAT

105

79

32.3

79

32.3

Vedanta Ltd – November 14, 2019

Particulars (` cr)

2QFY20E

2QFY19

y-o-y (%)

1QFY20

q-o-q (%)

Sales

19,799

22,705

-12.8

21,374

-7.4

EBIDTA

4,659

5,133

-9.2

5,198

-10.4

%

23.5

22.6

24.3

PAT

681

1,343

-49.3

1,351

-49.6

Oil & Natural Gas Corporation Ltd – November 14, 2019

Particulars (` cr)

2QFY20E

2QFY19

y-o-y (%)

1QFY20

q-o-q (%)

Sales

24,718

27,989

-11.7

26,555

-6.9

EBIDTA

13,102

14,471

-9.5

12,782

2.5

%

53.0

51.7

48.1

PAT

6,267

8,265

-24.2

5,904

6.2

Page Industries Ltd – November 14, 2019

Particulars (` cr)

2QFY20E

2QFY19

y-o-y (%)

1QFY20

q-o-q (%)

Sales

733

691

6.1

835

-12.2

EBIDTA

153

143

6.7

187

-18.4

%

20.8

20.7

22.4

PAT

107

93

15.5

111

-3.2

Bharti AirtelLtd – November 14, 2019

Particulars (` cr)

2QFY20E

2QFY19

y-o-y (%)

1QFY20

q-o-q (%)

Sales

210

20,422

-99.0

20,738

-99.0

EBIDTA

82

6,136

-98.7

8,243

-99.0

%

39.1

30.0

39.7

PAT

-14

119

-2866

4

www.angelbroking.com

Market Outlook

November 14, 2019

www.angelbroking.com

Top Picks

Company

Market Cap

(` Cr)

CMP

(`)

Target

(`)

Upside

(%)

Rationale

Blue Star

76,199

791

990

25.1

Favorable outlook for the AC industry to augur well

for Cooling products business which is out pacing

the market growth. EMPPAC division's profitability

to improve once operating environment turns

around.

ICICI Bank

32,11,423

497

532

7.1

Well capitalized with CAR of 18.1% which gives

sufficient room to grow asset base. Faster

resolution of NPA would reduce provision cost,

which would help to report better ROE.

Maruti Suzuki

21,54,812

7,133

8,552

19.9

GST regime and the Gujarat plant are expected to

improve the company’s sales volume and margins,

respectively.

Safari Industries

12,578

563

1,000

77.6

Third largest brand play in luggage segment

Increased product offerings and improving

distribution network is leading to strong growth in

business. Likely to post robust growth for next 3-4

years

Parag Milk Foods

11,133

132

200

51.1

One of the leading Indian dairy products

companies in India created strong brands in dairy

products. Rising revenue share of high-margin

Value Added Products and reduction in interest cost

is likely to boost margins and earnings in next few

years.

HDFC Bank

69,18,228

1,264

1,390

10.0

HDFC Bank maintained its steady growth in the

4QFY18. The bank’s net profit grew by 20.3%.

Steady growth in interest income and other income

aided PAT growth. The Strong liability franchise

and healthy capitalisation provides strong earning

visibility. At the current market price, the bank is

trading at 3.2x FY20E ABV.

Amber Enterprises

31,407

999

1,100

10.1

Market leader in the room air conditioner (RAC)

outsourced manufacturing space in India with a

market share of 55.4%. It is a one-stop solutions

provider for the major brands in the RAC industry

and currently serves eight out of the 10 top RAC

brands in India

Bata India

2,19,017

1,704

1,865

9.4

BIL is the largest footwear retailer in India, offering

footwear, accessories and bags across brands. We

expect BIL to report net PAT CAGR of ~16% to

~`3115cr over FY2018-20E mainly due to new

product launches, higher number of stores addition

and focus on women’s high growth segment and

margin improvement

5

www.angelbroking.com

Market Outlook

November 14, 2019

www.angelbroking.com

Continued...

Company

Market Cap

(` Cr)

CMP

(`)

Target

(`)

Upside

(%)

Rationale

Shriram Transport Finance

2,54,389

1,121

1,410

25.8

SHTF is in the sweet spot with benefits from

stronger CV volumes, NIMs unaffected by

rising bond yields on the back of stronger

pricing power and an enhancing ROE by

750bps over FY18-20E, supported by decline

in credit cost.

GMM Pfaudler Ltd

21,231

1,452

1,740

19.8

GMM Pfaudler Limited (GMM) is the Indian

market leader in glass-lined (GL) steel

equipment. GMM is expected to cross CAGR

15%+ in revenue over the next few years

mainly led by uptick in demand from user

industries and it is also expecting to increase

its share of non-GL business to 50% by 2020.

RBL Bank

1,47,864

343

410

19.4

We believe advance to grow at a healthy

CAGR of 35% over FY18-20E. Below peers

level ROA (1.2% FY18) to expand led by

margin expansion and lower credit cost.

Larsen & Toubro

19,88,735

1,417

1,850

30.6

The company has a strong order backlog of

~` 3lakh cr. and a very strong pipeline of `9

lakh cr. for FY2020. We are positive on

the prospects of the Company given the

Government’s thrust on Infrastructure with

over 100lakh cr. of investments lined up over

the next 5 years. Reduction in tax rate

for domestic companies to 22% from 30% will

improve profitability for the company.

Ultratech Cement

11,93,997

4,137

4,982

20.4

Post merger of Century textile’s cement

division of 13.4mn TPA from H2FY20

company will have ~110mn TPA of capacity

with a dominant position in West and central

India. We are positive on the long term

prospects of the Company given ramp up

from acquired capacities and pricing

discipline in the industry. Reduction in tax rate

for domestic companies to 22% from 30% will

improve profitability for the company.

Source: Company, Angel Research

6

www.angelbroking.com

Market Outlook

November 14, 2019

www.angelbroking.com

Fundamental Call

Company

Market Cap

(` Cr)

CMP

(`)

Target

(`)

Upside

(%)

Rationale

CCL Products

26,885

202

360

78.1

CCL is likely to maintain the strong growth

trajectory over FY18-20 backed by capacity

expansion and new geographical foray

Greenply Industries

19,614

160

256

60.1

Greenply Industries Ltd (GIL) manufactures

plywood & allied products and medium density

fibreboards (MDF). GIL to report net revenue CAGR

of ~14% to ~`2,478cr over FY2017-20E mainly

due to healthy growth in plywood & lamination

business on the back of strong brand and

distribution network

L&T Finance Holding

1,97,950

99

150

51.6

L&T Fin’s new management is on track to achieve

ROE of 18% by 2020 and recent capital infusion of

`3000cr would support advance growth.

Aditya Birla Capital

2,00,730

87

118

35.9

We expect financialisation of savings and

increasing penetration in Insurance & Mutual fund

would ensure steady growth.

KEI Industries

43,803

551

612

11.1

High order book execution in EPC segment, rising

B2C sales and higher exports to boost the revenues

and profitability

Nilkamal

18,341

1,229

NA

NA

We forecast Nilkamal to report top-line CAGR of

~9% to `2,635cr over FY17-20E on the back of

healthy demand growth in plastic division. On the

bottom-line front, we estimate ~10% CAGR to

`162cr owing to improvement in volumes.

Siyaram Silk Mills

10,790

230

NA

NA

Strong brands and distribution network would

boost growth going ahead. Stock currently trades

at an inexpensive valuation.

Music Broadcast Limited

8,241

30

NA

NA

Expected to benefit from the lower capex

requirement and 15 year long radio broadcast

licensing.

Inox Winds

7,368

33

NA

NA

We expect Inox Wind to report exponential growth

in top-line and bottom-line over FY19-20E. The

growth would be led by changing renewable

energy industry dynamics in favor of wind energy

segment viz. changes in auction regime from Feed-

In-Tariff (FIT) to reverse auction regime and

Government’s guidance for 10GW auction in FY19

and FY20 each.

Ashok Leyland

2,32,641

79

NA

NA

Considering the strong CV demand due to change

in BS-VI emission norms (will trigger pre-buying

activities), pick up in construction activities and no

significant impact on industry due to recent axle

load norms, we recommend BUY on Ashok Leyland

at current valuations.

Jindal Steel & Power Limited

1,53,818

151

NA

NA

We expect JSPL’s top line to grow at 27% CAGR

over FY19-FY20 on the back of strong steel

demand and capacity addition. On the bottom line

front, we expect JSPL to turn in to profit by FY19 on

back of strong operating margin improvement.

7

www.angelbroking.com

Market Outlook

November 14, 2019

www.angelbroking.com

Continued...

Company

Market Cap

(` Cr)

CMP

(`)

Target

(`)

Upside

(%)

Rationale

Yes Bank

1,86,174

73

NA

NA

Well planned strategy to grow small business

loans and cross-selling would propel fees

income. We expect YES to grow its advance

much higher than industry and improvement

in asset quality to support profitability.

GIC Housing

8,619

160

NA

NA

We expect loan book to grow at 24.3% over

next two year; change in borrowing mix will

help in NIM improvement

Source: Company, Angel Research

4

www.angelbroking.com

Market Outlook

November 14, 2019

www.angelbroking.com

Macro watch

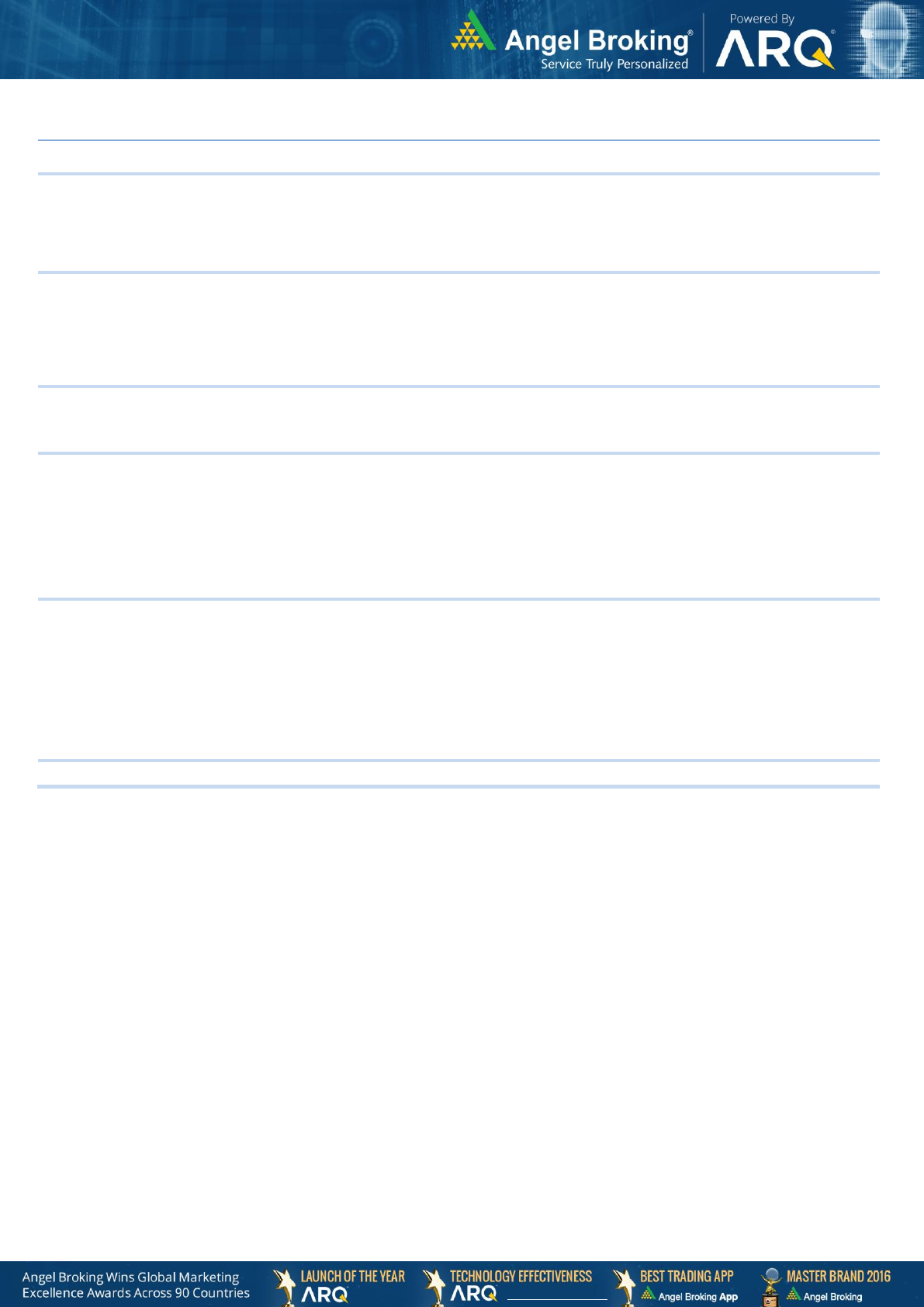

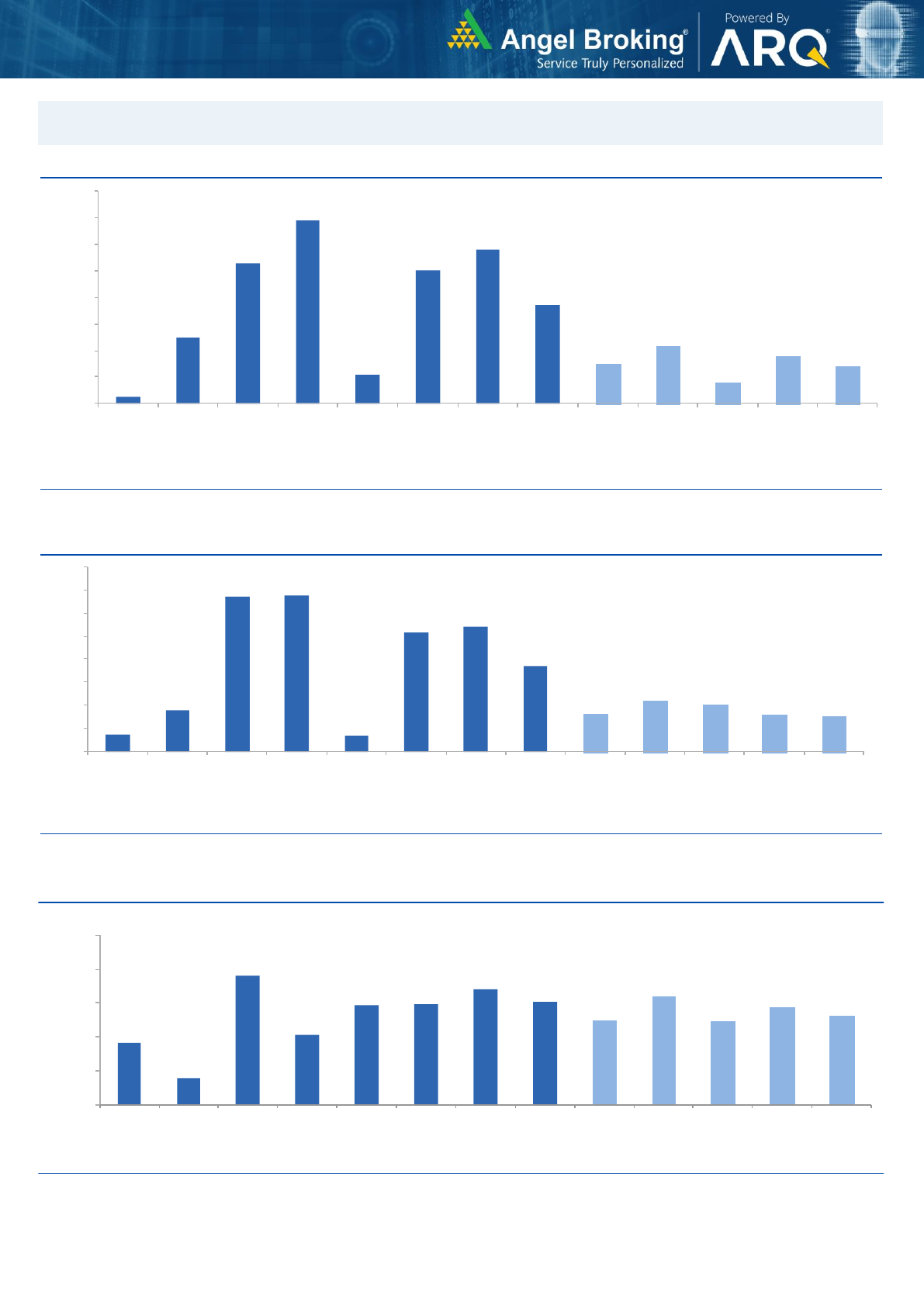

Exhibit 1: Quarterly GDP trends

Source: CSO, Angel Research

Exhibit 2: IIP trends

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Source: MOSPI, Angel Research

Exhibit 4: Manufacturing and services PMI

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Exhibit 5: Exports and imports growth trends

Source: Bloomberg, Angel Research As of 24 Sep, 2019

Exhibit 6: Key policy rates

Source: RBI, Angel Research

6.0

6.8

7.7

8.1

8.0

7.0

6.6

5.8

5.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

1QFY18

2QFY18

3QFY18

4QFY18

1QFY19

2QFY19

3QFY19

4QFY19

1QFY20

(%)

4.6

8.4

0.2

2.5

1.6

0.2

2.7

3.2

4.6

1.2

4.3

-

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

Sep-18

Oct-18

Nov-18

Dec-18

Jan-19

Feb-19

Mar-19

Apr-19

May-

19

Jun-19

Jul-19

(%)

3.7

3.4

2.3

2.1

2.0

2.6

2.9

3.0

3.1

3.2

3.2

3.2

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

Sep-18

Oct-18

Nov-18

Dec-18

Jan-19

Feb-19

Mar-19

Apr-19

May-19

Jun-19

Jul-19

Aug-19

(%)

47

48

49

50

51

52

53

54

55

Sep-18

Oct-18

Nov-18

Dec-18

Jan-19

Feb-19

Mar-19

Apr-19

May-19

Jun-19

Jul-19

Aug-19

Mfg. PMI

Services PMI

(20.0)

(15.0)

(10.0)

(5.0)

0.0

5.0

10.0

15.0

20.0

Sep-18

Oct-18

Nov-18

Dec-18

Jan-19

Feb-19

Mar-19

Apr-19

May-19

Jun-19

Jul-19

Aug-19

Exports yoy growth

Imports yoy growth

(%)

5.4

5.15

4.00

3

3.5

4

4.5

5

5.5

6

6.5

7

Oct-18

Oct-18

Nov-18

Dec-18

Dec-18

Jan-19

Feb-19

Feb-19

Mar-19

Apr-19

Apr-19

May-19

Jun-19

Jul-19

Jul-19

Aug-19

Sep-19

Sep-19

Repo rate

Reverse Repo rate

CRR

(%)

5

www.angelbroking.com

Market Outlook

November 14, 2019

www.angelbroking.com

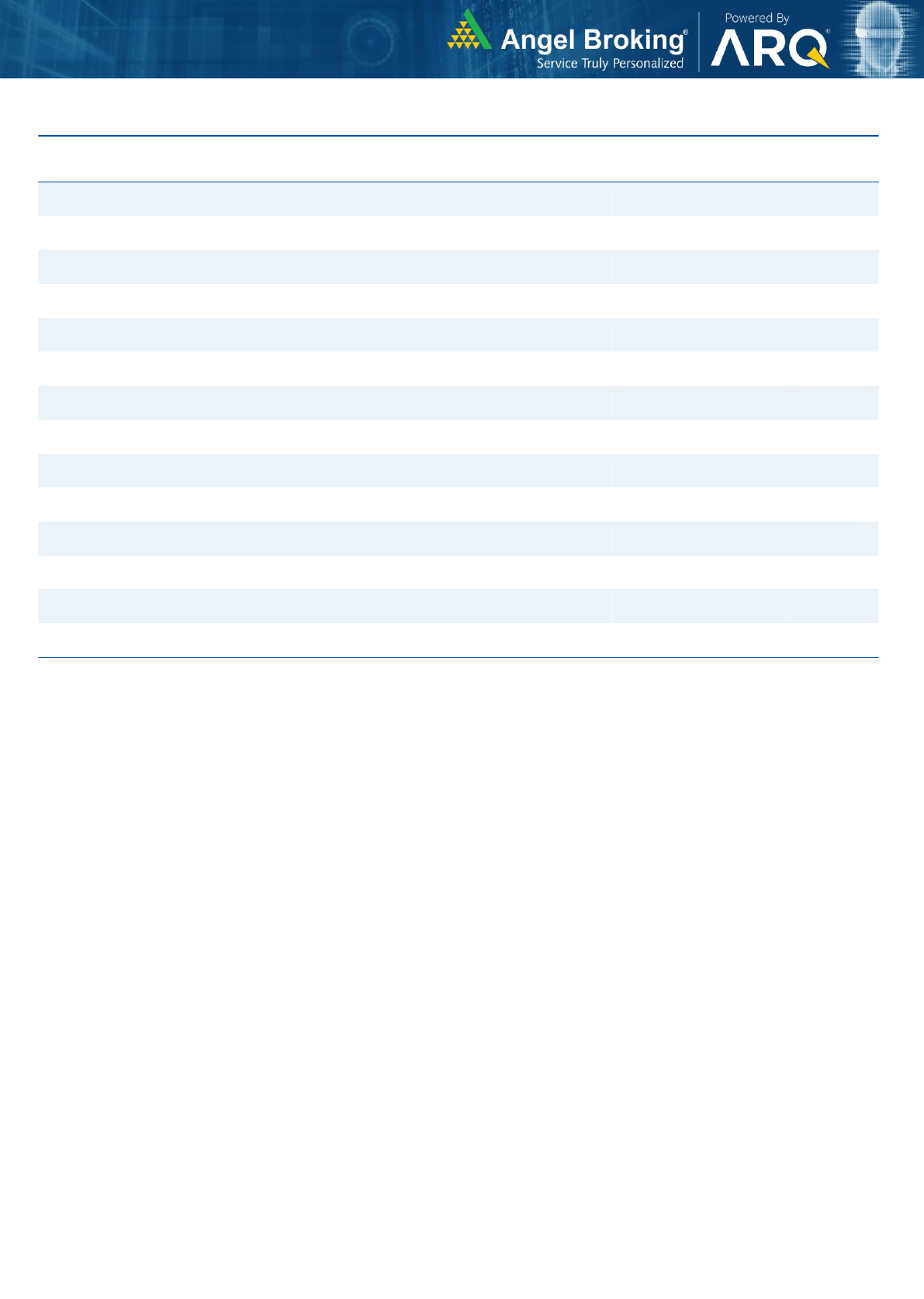

Global watch

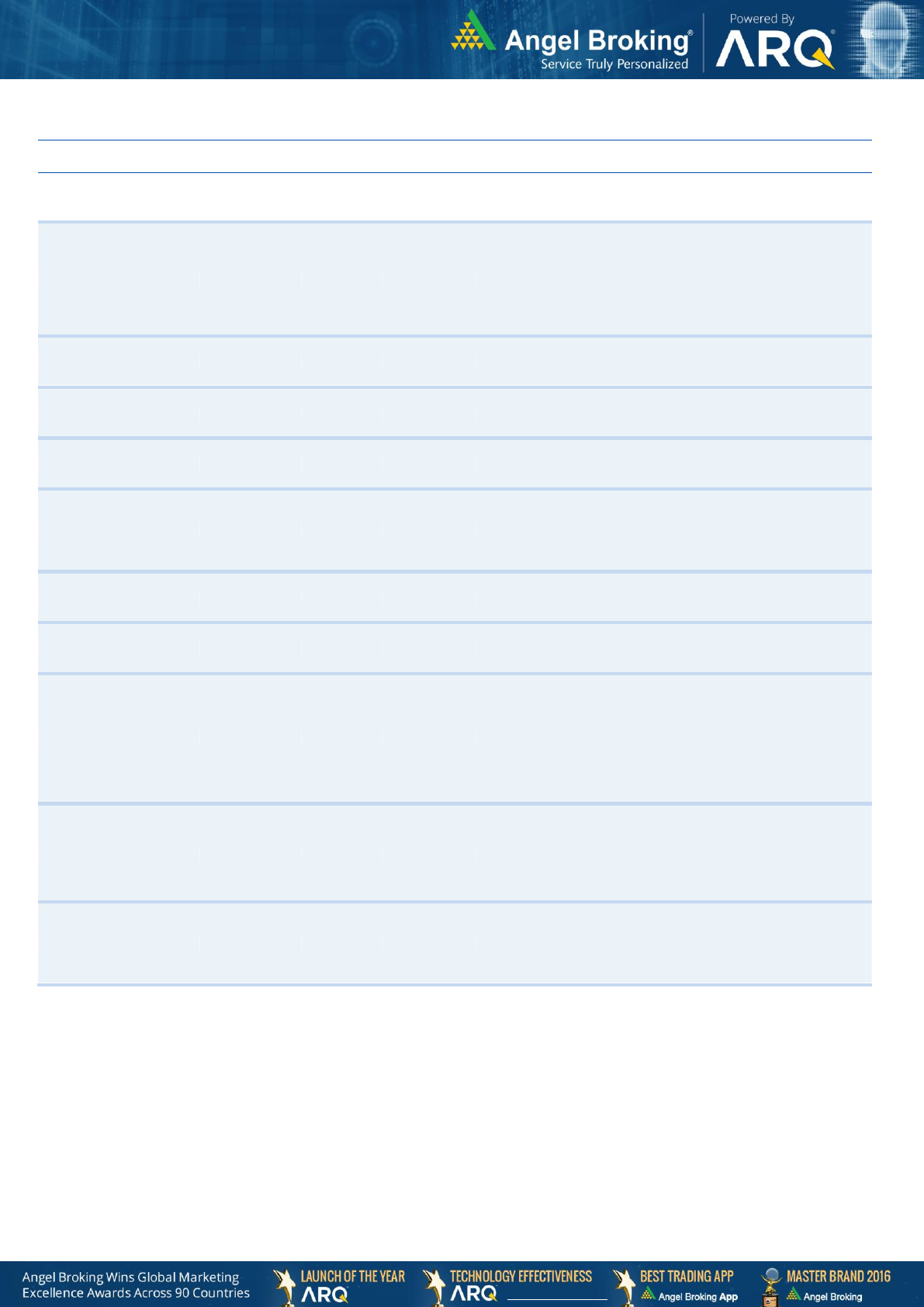

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

Source: Bloomberg, Angel Research

Exhibit 2: 2017 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

Source: IMF, Angel Research As of 24 Sep, 2019

0.3

2.5

5.3

6.9

1.1

5.0

5.8

3.7

1.5

2.2

0.8

1.8

1.4

-

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

Brazil

Russia

India

China

South

Africa

Indonesia

Malaysia

Thailand

UK

USA

Germany

France

Japan

(%)

0.7

1.8

6.7

6.8

0.7

5.2

5.4

3.7

1.7

2.2

2.0

1.6

1.5

-

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

Brazil

Russia

India

China

South Africa

Indonesia

Malaysia

Thailand

UK

USA

Germany

France

Japan

(%)

9.1

4.0

19.1

10.2

14.6

14.8

17.0

15.2

12.5

16.0

12.2

14.3

13.2

-

5.0

10.0

15.0

20.0

25.0

Brazil

Russia

India

China

South

Africa

Indonesia

Malaysia

Thailand

UK

USA

Germany

France

Japan

(x)

6

www.angelbroking.com

Market Outlook

November 14, 2019

www.angelbroking.com

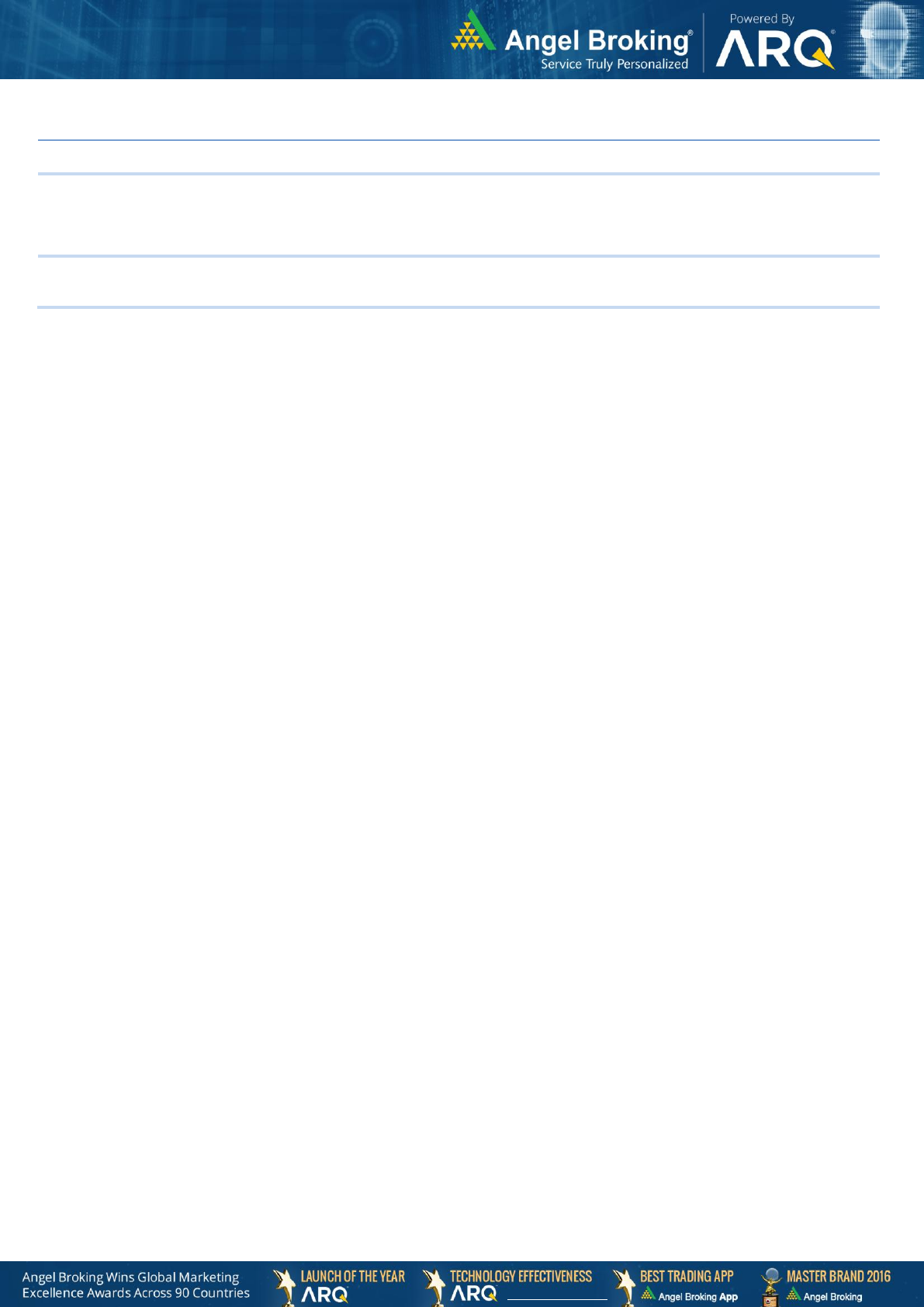

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

1,04,745

3.6

3.7

32.0

Russia

Micex

2,747

0.3

-0.7

11.0

India

Nifty

11,474

4.1

-2.7

5.0

China

Shanghai Composite

2,905

0.7

-2.5

3.0

South Africa

Top 40

47,975

-2.8

-0.7

4.2

Mexico

Mexbol

43,416

1.4

-0.1

-9.7

Indonesia

LQ45

942

-4.5

-7.6

5.1

Malaysia

KLCI

1,557

-1.6

-4.7

-8.9

Thailand

SET 50

1,067

0.2

0.6

-8.9

USA

Dow Jones

26,917

1.9

1.2

1.7

UK

FTSE

7,408

2.8

-0.2

-1.4

Japan

Nikkei

21,756

5.1

2.3

-9.8

Germany

DAX

12,428

4.1

0.2

1.5

France

CAC

5,678

3.6

2.5

3.4

Source: Bloomberg, Angel Research As of 05 October, 2019

7

www.angelbroking.com

Market Outlook

November 14, 2019

www.angelbroking.com

Exhibit 7: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

17-08-2018

Top Picks

Ashok Leyland

128

156

Open

10-08-2018

Top Picks

Inox Wind

107

127

Open

30-11-2018

Top Picks

TTK Prstige

7,206

8,200

Open

09-08-2018

Top Picks

TTK Prstige

6,206

7,500

06-07-2018

Top Picks

Aurobindo Pharma

603

780

Open

30-08-2018

Top Picks

RBL Bank

626

690

Open

06-07-2018

Top Picks

RBL Bank

565

670

06-07-2018

Top Picks

Yes Bank

348

418

Open

30-06-2018

Top Picks

Jindal Steel & Power

222

350

Open

20-06-2018

Top Picks

Shriram Transport Finance Com

1,466

1,764

Open

30-07-2018

Top Picks

Bata India

918

1,007

Open

23-07-2018

Top Picks

Bata India

842

955

01-07-2018

Top Picks

Bata India

862

948

18-06-2018

Top Picks

Bata India

779

896

14-06-2018

Top Picks

Amber Enterprises

1,026

1,230

Open

07-06-2018

Top Picks

M&M

918

1050

Open

04-05-2018

Top Picks

M&M

860

990

03-05-2018

Fundamental

L&T Finance Holding

171

210

Open

02-05-2018

Top Picks

HDFC Bank

1944

2315

Open

04-05-2018

Top Picks

Matrimony.com Ltd

573

1016

Closed(17/08/2018)

20-04-2018

Top Picks

Matrimony.com Ltd

781

984

15-05-2018

Top Picks

Parag Milk Foods Limited

310

410

Open

16-04-2018

Top Picks

Parag Milk Foods Limited

249

333

27-08-2018

Top Picks

GMM Pfaudler Limited

1,170

1,287

Open

18-08-2018

Top Picks

GMM Pfaudler Limited

1,024

1,200

07-08-2018

Top Picks

GMM Pfaudler Limited

984

1,100

29-06-2018

Fundamental

GMM Pfaudler Limited

932

1,020

14-05-2018

Fundamental

GMM Pfaudler Limited

818

900

06-04-2018

Fundamental

GMM Pfaudler Limited

712

861

07-03-2018

Fundamental

Ashok Leyland Ltd

139

163

Closed (26/04/2018)

03-03-2018

Fundamental

Greenply Industries

340

395

Open

27-08-2018

Top Picks

Safari Industries

974

1,071

Open

14-08-2018

Top Picks

Safari Industries

868

1,000

07-08-2018

Top Picks

Safari Industries

788

870

16-07-2018

Top Picks

Safari Industries

693

800

16-04-2018

Top Picks

Safari Industries

651

750

21-02-2018

Top Picks

Safari Industries

532

650

31-05-2018

Top Picks

HSIL Ltd

348

Closed (31/05/2018)

16-02-2018

Top Picks

HSIL Ltd

433

510

07-02-2018

Fundamental

Elantas Beck India Ltd.

2155

2500

Open

01-02-2018

Top Picks

ICICI Bank

352

416

Open

01-02-2018

Top Picks

Aditya Birla Capital

167

218

Open

04-01-2018

Fundamental

CCL Products

278

360

Open

03-01-2018

Fundamental

Nilkamal Ltd

1880

2178

Open

01-01-2018

Fundamental

Capital First Ltd

693

850

Closed (15/01/2018)

30-12-2017

Fundamental

Shreyans Industries Ltd

205

247

Closed

Source: Company, Angel Research

8

www.angelbroking.com

Market Outlook

November 14, 2019

www.angelbroking.com

Exhibit 8: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

Fundamental

Prism Cement Ltd

160

Closed (09/05/2018)

21-12-2017

Fundamental

Prism Cement Ltd

118

131

18-12-2017

Fundamental

Menon Bearings Limited

92

114

Closed (17/01/2018)

14-12-2017

Top Picks

Ruchira Papers Ltd.

188

244

Closed (09/02/2018)

17-05-2018

Top Picks

Century Plyboards India

280

Closed(17/05/2018)

28-11-2017

Top Picks

Century Plyboards India

317

400

19-12-2017

Top Picks

LT Foods

85

Closed(18/06/2018)

06-11-2017

Top Picks

LT Foods

74

96

16-10-2017

Fundamental

Endurance Technologies Ltd

1111

1277

Closed (01/12/2017)

11-09-2017

Top Picks

GIC Housing

533

655

Open

10-10-2017

Top Picks

Music Broadcast Limited

404

475

Open

20-07-2017

Top Picks

Music Broadcast Limited

368

434

07-07-2017

Fundamental

L&T Finance Holdings Ltd

149

179

Closed (28/8/2017)

06-07-2017

Fundamental

Syngene International

478

564

Closed (1/3/2018)

05-07-2017

Top Picks

Maruti

7371

10619

Open

05-06-2017

Top Picks

Karur Vysya Bank

127

100

Closed (12/03/2018)

23-05-2018

Top Picks

KEI Industries

481

589

Open

04-01-2017

Top Picks

KEI Industries

125

485

31-05-2018

Top Picks

Alkem Lab

1978

Closed (31/05/2018)

01-12-2016

Top Picks

Alkem Lab

1700

2441

17-10-2016

Top Picks

Asian Granito

267

534

Closed (18/02/2018)

17-05-2018

Top Picks

TV Today Network

460

Closed (17/05/2018)

04-08-2016

Top Picks

TV Today Network

297

603

05-04-2016

Top Picks

DHFL

189

720

Open

25-06-2018

Top Picks

Navkar Corporation

207

Closed(25/06/2018)

05-01-2016

Top Picks

Navkar Corporation

207

265

Open

08-12-2015

Top Picks

Blue Star

357

867

Open

30-10-2015

Top Picks

Siyaram Silk Mills

186

851

Open

Source: Company

9

www.angelbroking.com

Market Outlook

November 14, 2019

www.angelbroking.com

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER:

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.